Important

Wednesday, January 5, 2022 Update:

Effective Wednesday, January 5, 2022 at 12:01 a.m., the Province will return to the modified version of Step Two of the Roadmap to Reopen for at least 21 days (until January 26, 2022), subject to trends in public health and health system indicators. What does this mean?

- Restaurants, bars and other eating establishments:

- Indoor dining not permitted.

- Delivery, Drive-through, and pickup permitted, including alcohol.

- Personal care services:

- Permitted at 50% capacity

- Including tattoo parlours, barbershops, hair salons, day spas, and beauty salons.

- Saunas, steam rooms, and oxygen bars closed.

- Religious Services – including wedding and funeral services:

- Limited capacity at 50% of a particular room.

- Outdoor services are limited to the number of people that can maintain 2 metres of physical distance.

- Retail:

- Permitted at 50% capacity.

- Fitness classes, personal training, and individual/team sports training:

- Indoor sports and recreational fitness facilities, including gyms, are not permitted.

- outdoor facilities are permitted to operate but with the number of spectators not to exceed 50% occupancy and other requirements.

Click here for a detailed list.

Other questions on what can and cannot open? Call the Stop the Spread Information Hotline, Province of Ontario

For more information:

On this page:

- Government Supports for Business – Loans, Grants, Deferrals

- Grant – Ontario Covid-19 Small Business Relief Grant – $10,000 – Coming Soon

- Rebate – Ontario Business Costs Rebate Program – Available

- Grant – Hardest-Hit Businesses Recovery Program – Available

- Grant – Tourism and Hospitality Recovery Program – Available

- Grant – Canada Recovery Hiring Program – Available

- Loan/Grant – Jobs and Growth Fund – Available

- Grant – Canada Emergency Rent Subsidy – Available retroactively for past periods

- Grant – Canada Emergency Wage Subsidy – Available retroactively for past periods

- Grant – Ontario Small Business Support Grant – $20,000 – CLOSED

- Grant – Property Tax and Energy Bill Rebates – CLOSED

- Grant – Ontario Main Street Relief (PPE) Grant – Up to $1,000 – CLOSED

- Loan/Grant – Canada Emergency Business Account – Up to $60,000 – CLOSED

- Other – Temporary Ban on Commercial Evictions – No Longer Available

- Deferral – Deferment of Municipal Property Taxes – No Longer Available

- Loan – The Regional Relief and Recovery Fund – Up to $40,000 – CLOSED

- How to Contact Your Elected Representatives

- Other Resources to Support Your Business

Government Supports for Businesses

In response to the COVID-19 pandemic, the municipal, provincial and federal governments have put measures in place to protect the public. The Junction BIA will be providing information for its member businesses through this webpage and by email as necessary. We encourage members to rely on government sources to ensure that information is up-to-date and correct.

Primary Government Sources

- Federal Government Website – General Information on COVID-19 Response

- Provincial Government Website – General Information on COVID-19 Response

- Municipal Government Website – General Information on COVID-19 Response

Below is a continuously updating list of active and announced government programs and resources to support businesses and their workers during the COVID-19 pandemic response. We will work to keep this list up to date and relevant. We encourage members to let us know if they come across additional resources that could be helpful to our business community during this difficult time.

Questions?

- You can contact Matthew Mohan, Operations Manager if you have any questions or comments that we can assist you with at this time.

- Specific questions about the government supports outlined below? The One-Stop Information Portal, by the Toronto Board of Trade includes a handy chatbox, as well as all the resources and tools to help you manage the challenge you’re facing.

Thank you to our neighbours at The Waterfront BIA for providing much of the information & template used here.

Ontario Covid-19 Small Business Relief Grant: The government has announced the new Ontario Small Business Relief Grant, which will provide a payment $10,000 to help small business owners during this challenging period.

Eligible small businesses include those that:

- be required to close due to public health orders that took effect 12:01 a.m. on January 5, 2022

- have fewer than 100 employees as of December 31, 2021

- be an active business as of January 14, 2022

Eligible businesses that previously qualified for the Ontario Small Business Support Grant and are subject to closure under modified Step Two of the Roadmap to Reopen will be pre-screened to verify eligibility and will not need to apply to the new program.

Newly established and newly eligible small businesses will need to apply once the application portal opens in the coming weeks.

This is a grant and does NOT require repayment.

How to apply:

Applications to open soon. Click here for more information.

Status: Coming Soon

Provided by: The Provincial Government

Beneficial to: Business Owners

Ontario Business Costs Rebate Program: Businesses required to close or reduce capacity will receive rebate payments for a portion (50-100%) of the property tax and energy costs they incur while subject to these measures.

Eligible small businesses include those that:

- Are required to reduce capacity to 50 per cent, such as smaller retail stores. These will receive a rebate payment equivalent to 50% of their costs.

- Are required to close for indoor activities, such as restaurants and gyms. These will receive a rebate payment equivalent to 100 per cent of their costs.

Payments to eligible businesses will be retroactive to December 19, 2021 when public health measures were first effective.

This is a grant and does NOT require repayment.

How to apply:

- Collect proof of costs associated with property tax and energy bills.

- Click Here to apply.

If you have questions about the Ontario Business Costs Rebate Program, call ServiceOntario at 1-855-216-3090.

Status: Available

Provided by: The Provincial Government

Beneficial to: Business Owners

Hardest-Hit Businesses Recovery Program: Replacing the Canada Emergency Rent Subsidy and Canada Emergency Wage Subsidy, this program provides wage and/or rent subsidies to eligible businesses, from October 24, 2021 to May 7, 2022.

Eligible small businesses include those that:

- have a 12-month average revenue drop from March 2020 to February 2021 of at least 50%;

- have a claim period revenue drop of at least 50%; and

- don’t qualify for the Tourism and Hospitality Recovery Program

Answer a few questions to see what you qualify for.

How to apply:

- Calculate your wage or hiring subsidy and continue through the application.

- Calculate your rent subsidy and continue through the application.

Status: Available

Provided by: The Federal Government

Beneficial to: Business Owners

Tourism and Hospitality Recovery Program: Replacing the Canada Emergency Rent Subsidy and Canada Emergency Wage Subsidy, this program provides wage and/or rent subsidies to select tourism and hospitality businesses, from October 24, 2021 to May 7, 2022.

Eligible small businesses include those that:

- More than 50% of your eligible revenue comes from one or more of the tourism, hospitality, arts, entertainment, or recreation activities:

- a facility providing short-term lodging, such as a hotel, a motel, a cottage, a bed and breakfast, or a youth hostel.

- a business serving meals, snacks and beverages made to order for immediate consumption on or off the premises, such as a restaurant, a food truck, a cafeteria, a caterer, a coffee shop, a food concession, a bar, a pub, or a nightclub.

- You have a 12-month average revenue drop from March 2020 to February 2021 of at least 40%; and

- You have a claim period revenue drop of at least 40%

How to apply:

- Calculate your wage or hiring subsidy and continue through the application.

- Calculate your rent subsidy and continue through the application.

Status: Available

Provided by: The Federal Government

Beneficial to: Business Owners

Canada Recovery Hiring Program: The proposed Canada Recovery Hiring Program would provide eligible employers with a subsidy of up to 50 per cent of incremental remuneration paid to eligible active employees between June 6, 2021, and November 20, 2021.

This program allows eligible employers to hire new workers, increase workers’ hours, or increase wages at a pace that works for them. As with the Canada Emergency Wage Subsidy, eligible employers can apply for support after each four-week period of the program.

How to Apply:

- Click here to read more and calculate your eligible subsidy.

- Apply using your CRA My Business Account.

Status: Available.

Provided by: The Federal Government Government

Beneficial to: Business Owners

Jobs and Growth Fund: The Jobs and Growth Fund provides funding to businesses and organizations to help create jobs and position local economies for long-term growth. The fund provides $700 million nationally over three years, which includes up to $70 million dedicated to businesses created after January 2020 that meet eligibility criteria.

The fund could provide eligible businesses with interest-free repayable contributions for up to 50% of eligible costs. For non-profits, it could provide up to 90% in non-repayable contributions.

Eligible Activities include those that:

- support the transition to a green economy

- foster an inclusive recovery

- enhance Canada’s competitiveness through digital adoption to improve productivity and manufacturing processes

- strengthen capacity in sectors critical to Canada’s recovery and growth

Click here to read more and apply.

Status: Available.

Provided by: The Federal Government Government

Beneficial to: Business Owners

NEW: Canada Emergency Rent Subsidy (CERS): Canadian businesses that have seen a drop in revenue due to COVID-19 may be eligible for a subsidy to cover part of their commercial rent or property expenses, starting on September 27, 2020, until October 23, 2021.

- This subsidy will provide payments directly to qualifying renters and property owners, without requiring the participation of landlords.

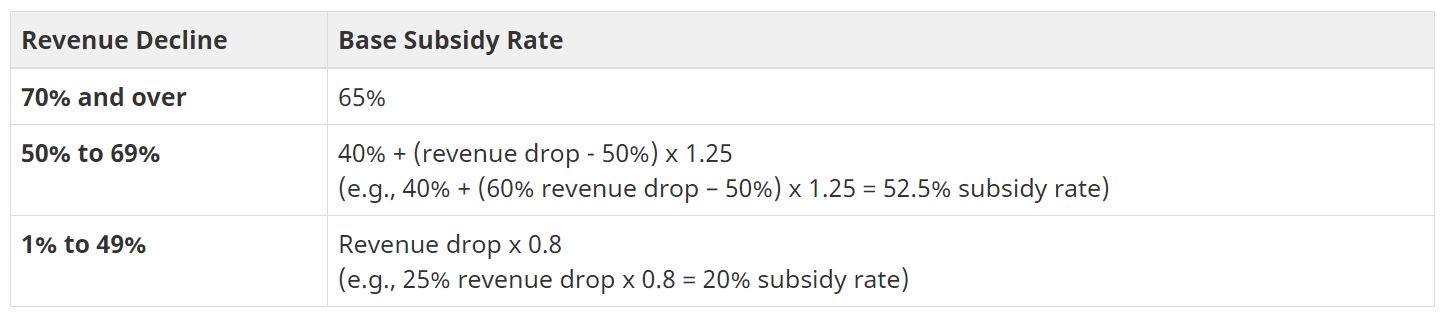

- There is no minimum revenue drop required to qualify. The rate your revenue has dropped will be used to calculate your subsidy amount, up to 65% of costs.

- Businesses required to temporarily closed due to a COVID-19 related public health order (nearly all small businesses in Toronto during lockdown) are eligible for an additional 25% (up to a total of 90%) rent subsidy.

Eligibility: To be eligible you must meet all of the following criteria:

- Had a CRA business number on September 27, 2020; OR had a payroll account on March 15, 2020; OR purchased business assets from another person or partnership that met the above.

- Are an eligible business, charity, or not-for-profit.

- Experiences a drop in revenue.

- Had eligible expenses.

How to Apply:

- Read details on the program and calculate eligibility here.

- Follow this Step-by-Step Guideline on Applying for CERS (compliments to Kensington Market BIA) and/or this Info Document from TABIA

- Apply using My Business Account.

Status: Now Available for periods up to Oct 23, 2021. Otherwise, see Hardest Hit Business Recovery Program, or Tourism and Hospitality Recovery Program

Provided by: The Federal & Provincial Governments

Beneficial to: Businesses & Property Owners

NEW: The Federal government announced last week that it has raised the maximum wage subsidy rate back to 75 per cent for the period beginning Sunday, December 20 until October 23, 2021.

Canada Emergency Wage Subsidy (CEWS): This wage subsidy will enable you to re-hire workers previously laid off as a result of COVID-19, help prevent further job losses, and better position you to resume normal operations following the crisis. New changes to CEWS include:

- Deadline to apply: 180 days after the end of the claim period.

Eligibility: To be eligible, you must meet all of the following criteria:

- Have had a CRA payroll account on March 15, 2020 (or another person made remittances on your behalf, or you purchased all business assets from another person).

- Be an eligible employer (such as an Individual, Corporation paying income tax, or non-profit).

- Have experienced a revenue drop. There is no minimum revenue drop required for claim periods 5-10 (July 5 onwards).

How to Apply:

- Read details on the program and calculate subsidy eligibility here.

- Apply using My Business Account.

Status: Now Available for periods up to Oct 23, 2021. Otherwise, see Hardest Hit Business Recovery Program, or Tourism and Hospitality Recovery Program

Provided by: The Federal Government

Beneficial to: Businesses Owners

Ontario Small Business Support Grant: The government has announced the new Ontario Small Business Support Grant, which will provide a minimum of $10,000 and up to $20,000 to help small business owners during this challenging period.

Eligible small businesses include those that:

- Are required to close or significantly restrict services due to the Province-wide Shutdown being imposed across the province effective 12:01 a.m. on December 26th

- Have fewer than 100 employees at the enterprise level

- Have experienced a minimum of 20% revenue decline in April 2020 compared to April 2019. Note, the application portal will provide alternative revenue decline comparator months for small businesses not in operation in April 2019 or April 2020.

This is a grant and does NOT require repayment.

How to apply:

- Read the Application Guide

- Click Here to apply.

Check Your Status: https://www.app.grants.gov.on.ca/msrf/#/home#BSGStatusWindow . The applicants would need to scroll down to the section marked “Check Ontario Small Business Support Grant application status.” To check application status, authorization number and CRA business number are required.

Questions? If you have questions about your application, including how to make corrections, you can call the Program at 416-325-6691 or email them at SmallBusSupportGrant@ontario.

Application portal closes March 31, 2021.

Status: CLOSED – See Ontario Small Business Relief Grant

Provided by: The Provincial Government

Beneficial to: Business Owners

NEW: Property Tax and Energy Bill Rebates: Businesses that are required to shut down or significantly restrict services (in areas with modified Stage 2 restrictions, control, or lockdown) can apply for rebates, provided in the form of grants, to help with their fixed costs. Eligible businesses could get rebates for:

- municipal and education property taxes

- energy costs, including electricity and natural gas (or where natural gas is not available, propane and heating oil)

Funding will cover the entire length of time that regionally targeted public health restrictions are in place.

**During lockdown, this includes almost all small businesses.

How to Apply: Submit proof of costs.

- For property tax rebates, this includes your property tax bills (or proof of costs associated with property taxes).

- For energy cost rebates, this includes a digital copy of the first energy bill (including electricity, natural gas, propane or other) you received on or after the day Stage 2 restrictions were put in place in your region. You can also submit other energy bills if your business is heated by propane or heating oil.

Status: CLOSED – See Ontario Business Costs Rebate Program

Provided by: The Provincial Government

Beneficial to: Property Owners and Businesses

NEW: PPE Grant: This one-time grant of up to $1000 will help businesses with the unexpected costs of PPE. To be eligible, your business must have two to nine employees and be in one of the following sectors:

- retail

- accommodation and food services

- repair and maintenance

- personal and laundry services

How to Apply:

- You will need to submit receipts or proof of costs for PPE purchased since March 17, 2020.

For a full list of eligible PPE and to apply, CLICK HERE.

Status: CLOSED

Provided by: The Provincial Government

Beneficial to: Businesses

NEW: The deadline to repay the balance of the loan without interest has been extended from December 31, 2022 to 2023.

NEW: CEBA support is being expanded from $40K to $60K. Applicants who have received the $40,000 CEBA loan may apply for the $20,000 expansion, which provides eligible businesses with an additional $20,000 in financing.

NEW: All applicants now have until March 31, 2021, to apply for CEBA

Canada Emergency Business Account – Loans of $60,000: Loans of $60,000 guaranteed by the government for qualifying small businesses and not-for-profits to help cover their operating costs.

These loans will be interest-free until December 31, 2023 and will be offered through qualified major Canadian Banks. Businesses that repay the balance of the loan on or before December 31, 2023 will result in loan forgiveness of 33 percent (up to $20,000).

Eligibility:

- To qualify for the Canadian Emergency Business Account, businesses and not-for-profits will need to demonstrate that they have paid between $20,000 to $1.5 million in total payroll in 2019; OR

To qualify under the expanded eligibility criteria, applicants with payroll lower than $20,000 would need:

- A business operating account at a participating financial institution

- A Canada Revenue Agency business number, and to have filed a 2018 or 2019 tax return.

- Eligible non-deferrable expenses between $40,000 and $1.5 million. Eligible non-deferrable expenses could include costs such as rent, property taxes, utilities, and insurance.

How to Apply:

BMO – BMO small and medium business clients can apply directly from the bank’s COVID-19 Business Support Page.

CIBC – Business owners may file an application through CIBC Online Banking for Business if they are currently registered to bank online. Upon approval, clients will receive a confirmation email from CIBC, and the $40,000 loan will be deposited into their existing CIBC Business Operating Account. The entire process is expected to take up to five business days from the date of submission.

RBC – To enroll for CEBA, clients must log into their RBC Online Banking for Business account. The online enrollment process for RBC clients will only be available through this platform.

Scotiabank – The application process will be available via the Scotia mobile banking app and Scotia online banking for Scotiabank Small Business Banking customers.

TD – TD Business Banking customers are able to apply for the Canada Emergency Business Account (CEBA) online at www.td.com/businessrelief.

Ultimately, small businesses and not-for-profits should contact their financial institution if they have any questions.

Status: CLOSED

Provided by:The Federal Government via the Bank of Canada, Office of the Superintendent of Financial Institutions, Major Canadian Banks.

Beneficial to: Businesses

Temporary Ban on Commercial Evictions: The Protecting Small Business Act, temporarily halts evictions of commercial tenants and protects them from being locked out or having their assets seized during COVID-19.

This applies to businesses that are eligible for CECRA from May 1, 2020 until August 31, 2020.

Details: According to information provided here by Minden Gross LLP, the key features are as follows:

- The Act will be automatically repealed on September 1, 2020, or on an earlier day to be named by proclamation of the Lieutenant Governor.

- The new Part IV of the CTA will apply to a tenancy in respect of which:

- the landlord is eligible to receive assistance under the CECRA program; or

- the landlord would be eligible to receive assistance under the CECRA program if the landlord had entered a rent reduction agreement with its tenant containing a moratorium on rent eviction.

- The moratorium starts on the day the Act comes into force (June 18, 2020) and ends on the day the Act is repealed (as described above).

- The Act mandates the following restrictions:

- Judges are precluded from ordering a writ of possession that is effective during the moratorium in respect of applicable tenancies if the basis for ordering the writ is an arrears of rent. This applies to any action or application that was commenced before, on or after the start of the moratorium. However, this prohibition does not apply in respect of an action or application by the landlord for a writ of possession if same was commenced after the landlord was approved to receive the assistance.

- During the moratorium, affected landlords are prohibited from exercising a right of reentry. Note that this is not limited to rent defaults. However, this prohibition does not apply if the right was exercised after the landlord was approved to receive CECRA assistance.

- Relatedly, if an affected landlord had previously exercised a right of re-entry during the period beginning May 1, 2020, and ending the day immediately before the start of the moratorium, the landlord must, as soon as reasonably possible:

- restore possession of the premises to the tenant (unless tenant declines to accept possession); or

- if the landlord is unable to restore possession of the premises to the tenant for any reason other than the tenant declining possession, the landlord must compensate the tenant for all damages sustained by the tenant by reason of the inability to restore possession. Additionally, if possession of the premises is so restored to the tenant, the tenancy is deemed to be reinstated on the same terms and conditions (unless otherwise agreed between the parties). However, these provisions do not apply if the right was exercised after the landlord was approved to receive assistance.

- During the moratorium, affected landlords may not exercise the remedy of distress. Additionally, if the landlord exercised the remedy of distress during the period beginning May 1, 2020 and ending the day before the start of the moratorium, said landlord must return to the tenant all seized goods and chattels that are unsold as of the start of the moratorium. However, these provisions do not apply if the seizure of the tenant’s goods or chattels was done after the landlord was approved to receive CECRA assistance.

- Landlords who contravene or fail to comply with the above-described restrictions are liable to the tenant for any damages sustained by the tenant as a result.

For more information and support, contact your local Member of Provincial Parliament.

Status: CLOSED

Provided by: The Provincial Government

Beneficial to: Businesses

Deferment of Municipal Property Taxes: Property owners will be able to request additional time to pay their taxes without incurring late payment penalties or interest charges for a six month period effective June 1 to November 30, 2020. This deferment is not automatic.

The additional time given to pay your property taxes does not reduce the amount of taxes that are owed to the City of Toronto.

Eligibility:

- Applicants must be able to demonstrate financial hardship stemming from COVID-19.

- Property owners must have a good payment history – up to date on their tax payments as of March 2020.

- All residential properties with a residential structure qualify. Commercial, shopping, office, industrial, multi-residential, or new multi-residential properties with a 2020 property assessment value equal to or under $10 million also qualify.

Deadlines:

- Property owners may apply to the program at any time between June 1 and October 31, 2020.

- Applications received and approved before July 31, 2020 will be eligible to have late payment penalties and/or interest amounts added to the tax account in June and July waived, as well as any penalties or interest incurred up to November 30, 2020.

- Applications approved after July 31, 2020 will be eligible to have late payment penalty or interest amounts waived from the date the application is approved up to November 30, 2020.

How to Apply: Submit your application and upload the required documents HERE.

Status: CLOSED

Provided by: City of Toronto

Beneficial to: Property Owners & Businesses

The Regional Relief and Recovery Fund (RRRF) – Loans of $40,000+: The program will seek to provide funding to help support small and medium-sized businesses that do not qualify for, or have been declined for, current Government of Canada COVID-19 relief funding. Two funding options are available to applicants for the RRRF through FedDev Ontario:

- Option 1: Up to $40,000 conditionally repayable interest-free contribution (loan). Repaying 75 percent, or up to $30,000 of the contribution, on or before December 31, 2022, will result in contribution forgiveness of 25 percent, or up to $10,000 of the total contribution.

- Option 2: Between $40,000 to $500,000 fully repayable contribution (loan). Interest-free until December 31, 2022.

Eligible applicants must be:

- A Canadian or provincially incorporated business, co-operative or an Indigenous-owned business located in southern Ontario with 1 to 499 full-time equivalent employees;

- Facing funding pressures with fixed operating costs, as a result of the COVID-19 pandemic;

- Have applied to other Government of Canada COVID-19 emergency credit relief measures, for which they are eligible, including:

- Canada Emergency Business Account (CEBA);

- Business Credit Availability Program (BCAP);

- BDC Co-Lending Program

- EDC Loan Guarantee Program

- BDC Working Capital Loans;

- Other applicable targeted and sector-specific COVID-19 programs (e.g., funding for Indigenous entrepreneurs, Farm Credit Canada);

- Planning to continue to operate its business or resume operations; and

- A viable business before the COVID-19 pandemic. Must be able to show through financial statements.

How to Apply:

Applications for funding are accepted on an ongoing basis with no submission deadlines, until the Fund is fully committed.

- Read thoroughly the Application Guide for instructions and details.

- Apply using the RRRF Application for Funding.

Status: CLOSED

Provided by: Federal Government via FedDev Ontario

Beneficial to: Businesses

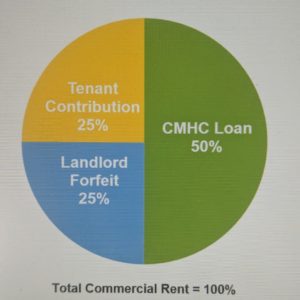

Canadian Emergency Commercial Rent Assistance (CECRA): The program will seek to provide loans, including forgivable loans, to commercial property owners who in turn will lower or forgo at least 75% of the rent of small businesses for the months of April (retroactive), May, and June. This will include:

- A 50% forgivable loan to property owners, who agree to cover the additional 25% of rent.

- The balance (25%) will be on the tenant. This way all three parties contribute to the solution.

Example: A $1000 lease = $500 Government Grant; $250 Property Owner Covered; $250 Tenant Covered.

Eligibility:

- Impacted small business tenants are businesses paying less than $50,000 per month in rent and who have temporarily ceased operations (generating no revenue) or have experienced at least a 70 per cent drop in pre-COVID-19 revenues. This support will also be available to non-profit and charitable organizations.

- CECRA for small businesses is administered undifferentiated for properties with mortgages, other forms of debt or no mortgages at all.

How to Apply:

- NEW: To help you prepare, sample versions of the application documents are available HERE. They are for illustrative purposes only but make sure that you (business owner and the property owner) review them before applying.

- Expected to be operational in the second half of May, with commercial property owners lowering the rents of their small business tenants payable by at least 75% for the months of April and May, retroactively, and for June.

- If rent has been collected at the time of approval, a credit to the tenant for a future month’s rent (i.e. July for April) is acceptable if agreed upon by both the property owner and the tenant. This can be a flexible 3-month period.

- The loan would also be contingent on the signing of a rent forgiveness agreement between impacted tenants and landlords. This would also include a moratorium on evictions for three months.

Photo Credit to The Waterfront BIA

More information to follow. See below for details (so far):

Status: CLOSED – See Canada Emergency Rent Subsidy, Hardest Hit Business Recovery Program, or Tourism and Hospitality Recovery Program

Provided by: Federal Government & Provincial Government via The Canadian Mortgage Housing Corporation

Beneficial to: Property Owners, Businesses

The Canada Emergency Relief Benefit – Benefit of $2,000/month: The benefit will provide $2000 / month for the next four months for workers who are not getting a paycheque because of COVID-19. To qualify the person must have received at least $5,000 in employment income and have no income form employment or self-employment for at least 14-days in a row. This includes:

- Persons who have lost their job due to COVID-19

- Persons who are contract workers who can no longer work due to COVID-19

- Persons who are Self-employed who can no longer work due to COVID-19 (such as independent small business owners)

- Persons who are sick or in quarantine and not receiving a salary due to COVID-19

- Persons who are looking after someone who is ill due to COVID-19

- Persons who are looking after children due to school & daycare closers caused by COVID-19

- Persons who are employed but are not receiving an income due to COVID-19 disruptions (Such as employees of non-essential businesses)

Early indications suggest that CERB will be an extremely flexible program to assist small businesses in maintaining their staffing – allowing employees to continue working while receiving the CERB benefit, with the opportunity for employers to top-up their workers’ compensation beyond the $2,000 that is provided to them by CERB.** However, this information is still being verified and we will provide updates on this program as they become available. As with many things, you don’t know for sure until you apply.

Note: Employees who receive the Canadian Emergency Wage Subsidy (75% temporary wage subsidy, outlined above) will not qualify to receive the $2000 Canadian Emergency Response Benefit.

How to Apply:

The application form will be available on April 6. If you have already applied for EI, you do not need to also apply for this new benefit, your claim will be automatically moved over to the CERB and you will receive the 16-week benefit. If needed, you can use your hours to apply for EI benefits after you have exhausted CERB benefits.

You can apply in one of these three ways:

- by accessing it on your CRA MyAccount secure portal;

- by accessing it from your secure My Service Canada Account; or

- by calling a toll free number equipped with an automated application process.

The applications will be CERB payments will be issued every four weeks and will be available from March 15, 2020 to Oct. 3, 2020. **

Status: No Longer Available – Replaced by Canada Worker Lockdown Benefit

Provided by: Federal Government

Beneficial to: Workers, Businesses Owners

**Information from trusted, non-official sources.

SME Loan Guarantee Programs: For small and medium sized enterprises (SMEs) that need additional support can apply for guaranteed loans through their financial institutions to help them weather the impacts of COVID-19. These loans, which will be supported through the Export Development Canada (EDC) and Business Development Bank (BDC) are intended for small and medium-sized companies that require greater help to meet their operational cash flow requirements. These two programs are outlined below:

- BDC Co-Lending Program for Small and Medium Enterprises: The Business Development Bank of Canada, together with major financial institutions, will co-lend term loans to SMEs for their operational cash flow requirements. Eligible businesses may obtain incremental credit amounts up to $6.25 million BDC’s portion of this program is up to $5 million maximum per loan. Eligible financial institutions will conduct the underwriting and manage the interface with their customers. The potential for lending for this program will be $20 billion.

- EDC Loan Guarantees. Small and Medium Enterprises (SMEs) can apply through their financial institutions to get operating credit and cash flow term loans up to $6.25 million, which will be guaranteed by the Export Development Canada (EDC). The program cap for this new loan program will be a total of $20 billion for export sector and domestic companies.

How to Apply:

Small businesses and not-for-profits should contact their financial institution to apply for these loans.

Status: No Longer Available

Provided by: The Federal Government via the Bank of Canada, Office of the Superintendent of Financial Institutions, Major Canadian Banks.

Beneficial to: Businesses

Deferral of Sales Tax Remittance (GST & HST): The Federal Government will be deferring the Goods and Services Tax / Harmonized Sales Tax (GST/HST) remittances and customs duty payments to June 30,2020.

- Monthly filers have to remit amounts collected for the February, March and April 2020 reporting periods;

- Quarterly filers have to remit amounts collected for the January 1, 2020 through March 31, 2020 reporting period; and

- Annual filers, whose GST/HST return or instalment are due in March, April or May 2020, have to remit amounts collected and owing for their previous fiscal year and instalments of GST/HST in respect of the filer’s current fiscal year.

Status: No Longer Available

Provided by: Federal Government via the Canadian Revenue Agency

Beneficial to: Businesses

Small Business Tax Deferral: The CRA will allow all businesses to defer, until after August 31, 2020, the payment of any income tax amounts that become owing on or after March 19, 2020 and before September 2020.

Status: No Longer Available

Provided by: Federal Government via the Canadian Revenue Agency

Beneficial to: Businesses

Flexible Banking Solutions – Including Mortgage Deferral: Canada’s 6 largest banks have made a commitment to work with personal and small business banking customers on a case-by-case basis to provide flexible solutions to help them manage through challenges due to COVID-19. This support will include up to a six-month payment deferral for mortgages and the opportunity for relief on other credit products.

How to Apply:

Individual Canadians or business owners facing hardship are encouraged to contact their bank directly to discuss options that could be available to them.

Status: Available Immediately, Case-by-Case

Provided by: Federal Government via the Bank of Canada, Office of the Superintendent of Financial Institutions, Major Canadian Banks.

Beneficial to: Businesses, Property Owners, Workers

Provincial Tax Relief: The province announced that it will provide five months of interest and penalty relief for businesses to file and make payments for the majority of provincially administered taxes.

The relief period does not include business accounts with outstanding taxes, interest or penalties owing to the government from previous filing periods. Existing debts from before the relief period will continue to accrue interest.

How to Apply:

Relief is automatic. If a business is unable to file their return or remittance during the relief period, they do not need to contact or notify the Ministry of Finance. Penalties and interest will be waived automatically for all late returns or remittances by Ontario businesses during the relief period.

Ontario businesses are required to file any late returns or remittances by the end of the relief period.

Status: No Longer Available – See Ontario Business Costs Rebate Program

Provided by: Provincial Government

Beneficial to: Businesses

Grace Period for Municipal Property Tax: The City of Toronto will provide a grace period for property tax payments and payment penalties for businesses for 60 days, starting March 16, 2020:

- For businesses on the three-instalment payment plan: the April 1 tax due date is extended to June 1, 2020;

- For property owners on the 11-instalment pre-authorized payment plan, the 2020 due dates will be extended by 60 days;

- Late payment penalties are waived for 60 days (as of March 16, 2020).

How to Apply:

Click here for details.

Status: No Longer Available

Provided by: Municipal Government.

Beneficial to: Businesses, Property Owners

Grace Period for Municipal Utility Bills – Water/Sewer Service and Solid Waste Management charges where applicable: The City is extending the due date for all utility bills issued to businesses by an additional 60 days in addition to the current 21 days to give utility customers an additional 60 days to make payment to take advantage of the early payment discount.

Status: No Longer Available

Provided by: Provincial Government.

Beneficial to: Businesses, Property Owners

24-Hour Retail Delivery Noice Exemption: All retail businesses are noise exempt from the City’s Noise Bylaw to facilitate after-hour deliveries. Retailers can receive deliveries 24 / 7 to ensure goods remain in stock.

Status: No Longer Available

Provided by: Provincial, Municipal Government.

Beneficial to: Businesses

Restaurants and Bars May Now Sell Liquor w/ Takeout and Delivery: The AGCO will now allow bar and restaurant licensees to temporarily sell beer, wine and spirits as part of a food order for takeout or delivery. These changes are effective immediately and last until December 31, 2020.

Status: Available Immediately

Provided by: Provincial Government via the AGCO

Beneficial to: Businesses

Contact Your Elected Representatives

The Junction BIA is in contact with our elected representatives to ensure that the concerns of our members are heard. Further, the Ontario BIA Association (OBIAA) and the Toronto Association of BIAs (TABIA) provide representations and lobbying on behalf of our BIA to all levels of government. However, business & property owners may be interested in reaching out to their elected members of government themselves. Should it interest you, you can:

- Download, Edit, and Send the Urgent Request for April 1 Small Business Relief Letter to the emails below.

- Share a letter by our provincial representative, MPP Bhutila Karpoche, calling on the provincial government to establish Rent Relief for Small Businesses. See emails below.

- Read, sign, and share a Petition to the Federal Government to further support small business, urging them to direct their COVID-19 aid package for small businesses away from providing credit and toward rent relief, labour subsidies, and debt deferral.

- Write your own letter or email about your experience as a commercial property/business owner!

See below for the emails of our elected representatives and members of government:

- Premier Doug Ford, premier@ontario.ca

- MPP Vic Fedeli, Minister of Economic Development, vic.fedeli@pc.ola.org

- MPP Prabmeet Singh Sarkaria, Associate Minister of Small Business, prabmeet.sarkaria@pc.ola.org

- Andrea Horwath, Leader of the Official Opposition in Ontario, horwatha-qp@ndp.on.ca

- MPP Bhutila Kharpoche, Parkdale-High Park, bkarpoche-CO@ndp.on.ca

- Prime Minister Justin Trudeau, justin.trudeau@parl.gc.ca or at https://pm.gc.ca/en/connect/contact

- MP Arif Virani, Parkdale-High Park, ARIF.VIRANI@parl.gc.ca

- MP Melanie Joly, Minister of Economic Development, melanie.joly@parl.gc.ca

- MP Mary Ng, Minister of Small Business, mary.ng@parl.gc.ca

- Mayor John Tory, City of Toronto, mayor_tory@toronto.ca

- Councillor Gord Perks, City of Toronto Ward 4, councillor_perks@toronto.ca

Other Resources

Other Resources small businesses may find useful:

- Promotion for Junction Business Offerings: We have publicized a list of all operating businesses with the community, sharing Gift Card, Delivery, and Pick-up Offerings. Please Like, Share, and Comment on these posts! If you have any Junction Business Offerings that you would like to share with the public and have not yet signed up (or require a revision), please CLICK HERE.

- The Pandemic Preparedness Toolkit for Businesses: It is critical that businesses are equipped with the knowledge, skills, and resources needed to respond to protect public health and ensure the continued essential operations of their organizations. The guidelines and resources contained in This Toolkit have been prepared by the Ontario Chamber of Commerce to help businesses plan for and adapt to the disruption of COVID-19 and any future influenza pandemics.

- Small Business Grants Program: Facebook is offering a grant program to support small businesses that are experiencing disruptions resulting from the global outbreak of COVID-19. They will begin taking applications in the coming weeks. To stay informed and sign up for updates, CLICK HERE.

- Protective Equipment for Business: Astley Gilbert offers items that could help you protect your customers and employees: Indoor/outdoor floor decals to remind of social distancing; Thermoplastic barriers; & Face shields. If interested, contact Amy Arthur or call 416-288-2775.

- City of Toronto COVID-19 Business Survey: Click Here.

All prior updates and other resources & services re COVID-19, including Crime Prevention Tips, Digital Marketing Supports, and Rent Relief Options, are documented in our Member Resources page.